Brain-booster

/

23 Mar 2023

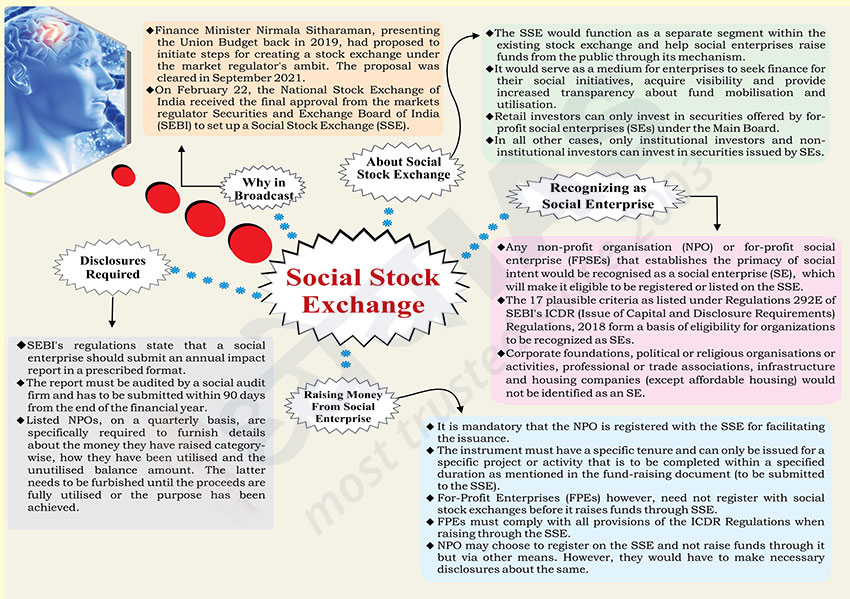

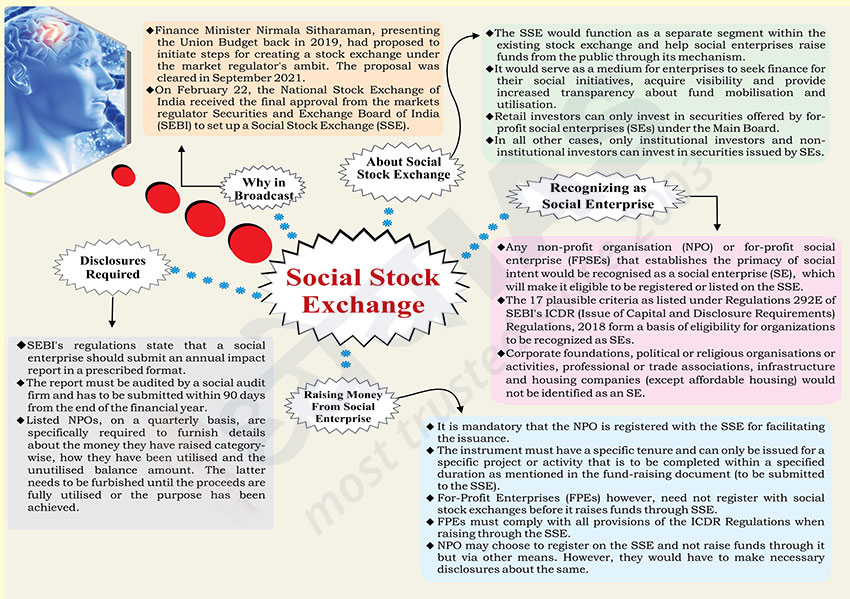

Brain Booster for UPSC & State PCS Examination (Topic: Social Stock Exchange)

Why in Broadcast?

- Finance Minister Nirmala Sitharaman, presenting the Union Budget back in

2019, had proposed to initiate steps for creating a stock exchange under the

market regulator's ambit. The proposal was cleared in September 2021.

- On February 22, the National Stock Exchange of India received the final

approval from the markets regulator Securities and Exchange Board of India (SEBI)

to set up a Social Stock Exchange (SSE).

About Social Stock Exchange

- The SSE would function as a separate segment within the existing stock

exchange and help social enterprises raise funds from the public through its

mechanism.

- It would serve as a medium for enterprises to seek finance for their

social initiatives, acquire visibility and provide increased transparency

about fund mobilisation and utilisation.

- Retail investors can only invest in securities offered by for profit

social enterprises (SEs) under the Main Board.

- In all other cases, only institutional investors and noninstitutional

investors can invest in securities issued by SEs.

Recognizing as Social Enterprise

- Any non-profit organisation (NPO) or for-profit social enterprise (FPSEs)

that establishes the primacy of social intent would be recognised as a

social enterprise (SE), which will make it eligible to be registered or

listed on the SSE.

- The 17 plausible criteria as listed under Regulations 292E of SEBI's

ICDR (Issue of Capital and Disclosure Requirements) Regulations, 2018 form a

basis of eligibility for organizations to be recognized as SEs.

- Corporate foundations, political or religious organisations or

activities, professional or trade associations, infrastructure and housing

companies (except affordable housing) would not be identified as an SE.

Raising Money From Social Enterprise

- It is mandatory that the NPO is registered with the SSE for facilitating

the issuance.

- The instrument must have a specific tenure and can only be issued for a

specific project or activity that is to be completed within a specified

duration as mentioned in the fund-raising document (to be submitted to the

SSE).

- For-Profit Enterprises (FPEs) however, need not register with social

stock exchanges before it raises funds through SSE.

- FPEs must comply with all provisions of the ICDR Regulations when

raising through the SSE.

- NPO may choose to register on the SSE and not raise funds through it but

via other means. However, they would have to make necessary disclosures

about the same.

Disclosures Required

- SEBI's regulations state that a social enterprise should submit an

annual impact report in a prescribed format.

- The report must be audited by a social audit firm and has to be

submitted within 90 days from the end of the financial year.

- Listed NPOs, on a quarterly basis, are specifically required to furnish

details about the money they have raised categorywise, how they have been

utilised and the unutilised balance amount. The latter needs to be furbished

until the proceeds are fully utilised or the purpose has been achieved.