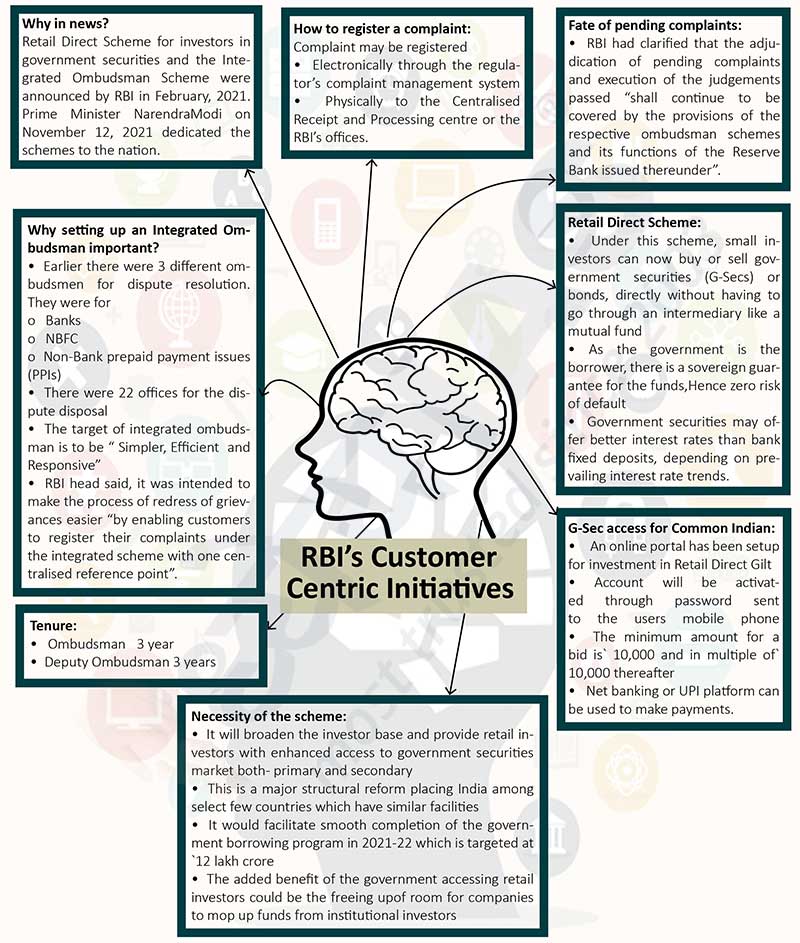

Why in news?

- Retail Direct Scheme for investors in government securities and the Integrated Ombudsman Scheme were announced by RBI in February, 2021. Prime Minister NarendraModi on November 12, 2021 dedicated the schemes to the nation.

Why setting up an Integrated Ombudsman important?

- Earlier there were 3 different ombudsmen for dispute resolution.

- They were for

- Banks

- NBFC

- Non-Bank prepaid payment issues (PPIs)

- There were 22 offices for the dispute disposal

- The target of integrated ombudsman is to be “ Simpler, Efficient and Responsive”

- RBI head said, it was intended to make the process of redress of grievances easier “by enabling customers to register their complaints under the integrated scheme with one centralised reference point”.

How to register a complaint:

Complaint may be registered

- Electronically through the regulator’s complaint management system

- Physically to the Centralised Receipt and Processing centre or the RBI’s offices.

Tenure:

- Ombudsman 3 year

- Deputy Ombudsman 3 years

Necessity of the scheme:

- It will broaden the investor base and provide retail investors with enhanced access to government securities market both- primary and secondary

- This is a major structural reform placing India among select few countries which have similar facilities

- It would facilitate smooth completion of the government borrowing program in 2021-22 which is targeted at `12 lakh crore

- The added benefit of the government accessing retail investors could be the freeing upof room for companies to mop up funds from institutional investors

Fate of pending complaints:

- RBI had clarified that the adjudication of pending complaints and execution of the judgements passed “shall continue to be covered by the provisions of the respective ombudsman schemes and its functions of the Reserve Bank issued thereunder”.

Retail Direct Scheme:

- Under this scheme, small investors can now buy or sell government securities (G-Secs) or bonds, directly without having to go through an intermediary like a mutual fund

- As the government is the borrower, there is a sovereign guarantee for the funds,Hence zero risk of default

- Government securities may offer better interest rates than bank fixed deposits, depending on prevailing interest rate trends.

G-Sec access for Common Indian:

- An online portal has been setup for investment in Retail Direct Gilt

- Account will be activated through password sent to the users mobile phone

- The minimum amount for a bid is` 10,000 and in multiple of` 10,000 thereafter

- Net banking or UPI platform can be used to make payments.