Brain-booster /

11 Nov 2022

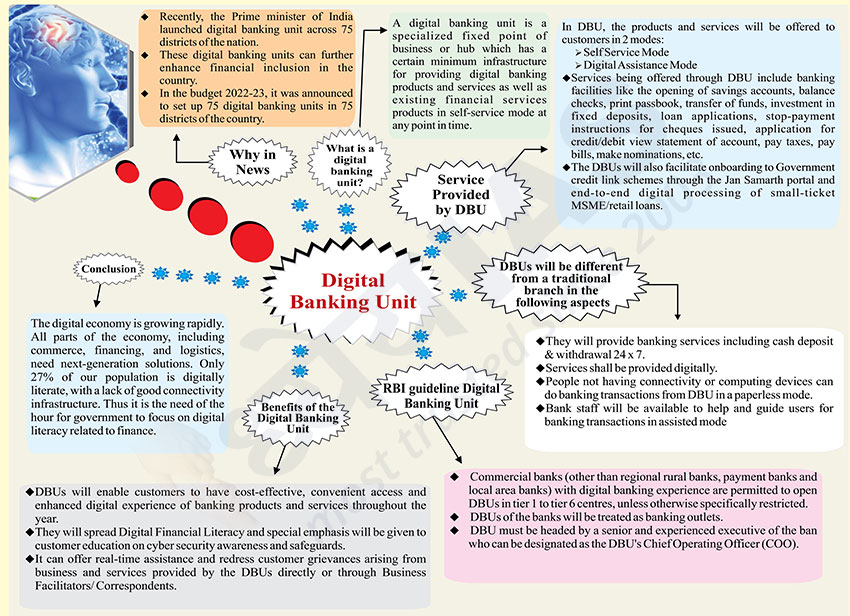

Brain Booster for UPSC & State PCS Examination (Topic: Digital Banking Unit)

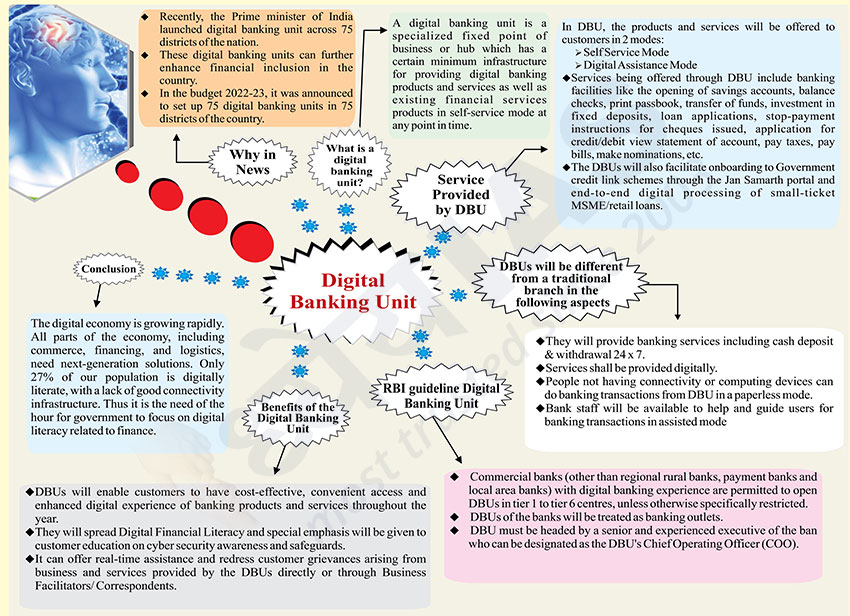

Why in News?

- Recently, the Prime minister of India launched digital banking unit

across 75 districts of the nation.

- These digital banking units can further enhance financial inclusion in

the country.

- In the budget 2022-23, it was announced to set up 75 digital banking

units in 75 districts of the country.

What is a digital banking unit?

- A digital banking unit is a specialized fixed point of business or hub

which has a certain minimum infrastructure for providing digital banking

products and services as well as existing financial services products in

self-service mode at any point in time.

Service Provided by DBU

- In DBU, the products and services will be offered to customers in 2

modes:

- Self Service Mode

- Digital Assistance Mode

- Services being offered through DBU include banking facilities like the

opening of savings accounts, balance checks, print passbook, transfer of

funds, investment in fixed deposits, loan applications, stop-payment

instructions for cheques issued, application for credit/debit view statement

of account, pay taxes, pay bills, make nominations, etc.

- The DBUs will also facilitate onboarding to Government credit link

schemes through the Jan Samarth portal and end-to-end digital processing of

small-ticket MSME/retail loans.

DBUs will be different from a traditional branch in the following aspects

- They will provide banking services including cash deposit & withdrawal

24 x 7.

- Services shall be provided digitally.

- People not having connectivity or computing devices can do banking

transactions from DBU in a paperless mode.

- Bank staff will be available to help and guide users for banking

transactions in assisted mode.

RBI guideline Digital Banking Unit

- Commercial banks (other than regional rural banks, payment banks and

local area banks) with digital banking experience are permitted to open DBUs

in tier 1 to tier 6 centres, unless otherwise specifically restricted.

- DBUs of the banks will be treated as banking outlets.

- DBU must be headed by a senior and experienced executive of the ban who

can be designated as the DBU's Chief Operating Officer (COO).

Benefits of the Digital Banking Unit

- DBUs will enable customers to have cost-effective, convenient access and

enhanced digital experience of banking products and services throughout the

year.

- They will spread Digital Financial Literacy and special emphasis will be

given to customer education on cyber security awareness and safeguards.

- It can offer real-time assistance and redress customer grievances

arising from business and services provided by the DBUs directly or through

Business Facilitators/ Correspondents.

Conclusion

- The digital economy is growing rapidly. All parts of the economy,

including commerce, financing, and logistics, need next-generation

solutions. Only 27% of our population is digitally literate, with a lack of

good connectivity infrastructure. Thus it is the need of the hour for

government to focus on digital literacy related to finance.