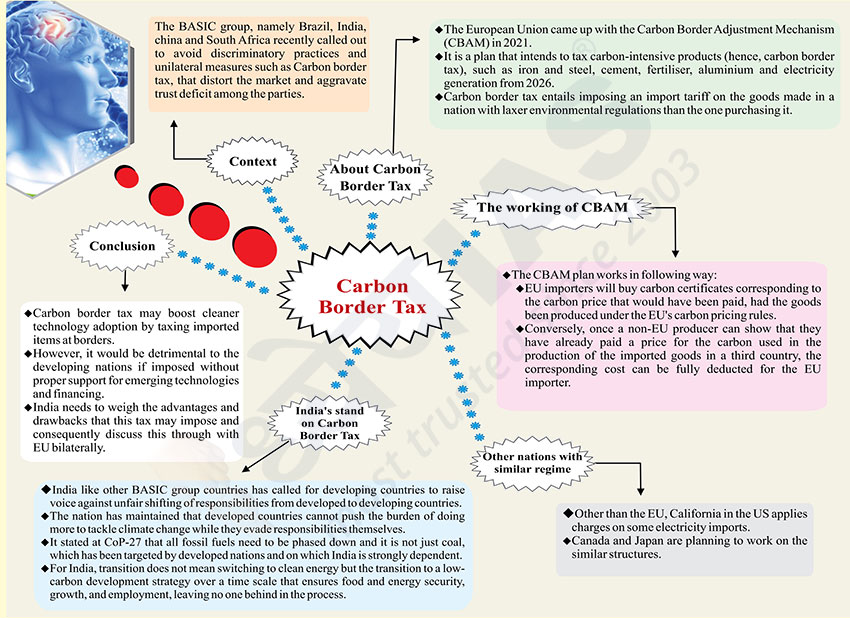

Context

- The BASIC group, namely Brazil, India, china and South Africa recently called out to avoid discriminatory practices and unilateral measures such as Carbon border tax, that distort the market and aggravate trust deficit among the parties.

About Carbon Border Tax

- The European Union came up with the Carbon Border Adjustment Mechanism (CBAM) in 2021.

- It is a plan that intends to tax carbon-intensive products (hence, carbon border tax), such as iron and steel, cement, fertiliser, aluminium and electricity generation from 2026.

- Carbon border tax entails imposing an import tariff on the goods made in a nation with laxer environmental regulations than the one purchasing it.

The working of CBAM

The CBAM plan works in following way:

- EU importers will buy carbon certificates corresponding to the carbon price that would have been paid, had the goods been produced under the EU's carbon pricing rules.

- Conversely, once a non-EU producer can show that they have already paid a price for the carbon used in the production of the imported goods in a third country, the corresponding cost can be fully deducted for the EU importer.

Other nations with similar regime

- Other than the EU, California in the US applies charges on some electricity imports.

- Canada and Japan are planning to work on the similar structures.

India's stand on Carbon Border Tax

- India like other BASIC group countries has called for developing countries to raise voice against unfair shifting of responsibilities from developed to developing countries.

- The nation has maintained that developed countries cannot push the burden of doing more to tackle climate change while they evade responsibilities themselves.

- It stated at CoP-27 that all fossil fuels need to be phased down and it is not just coal, which has been targeted by developed nations and on which India is strongly dependent.

- For India, transition does not mean switching to clean energy but the transition to a lowcarbon development strategy over a time scale that ensures food and energy security, growth, and employment, leaving no one behind in the process.

Conclusion

- Carbon border tax may boost cleaner technology adoption by taxing imported items at borders.

- However, it would be detrimental to the developing nations if imposed without proper support for emerging technologies and financing.

- India needs to weigh the advantages and drawbacks that this tax may impose and consequently discuss this through with EU bilaterally.