Relevance: GS-3: Indian Economy, mobilization of resources, growth, development and employment.

Key Phrases: MSME, KVIC, service, manufacturing, export, employment contribution,

Why in News?

- The Reserve Bank of India (RBI) vide circular, has allowed Scheduled Commercial Banks (SCBs) to deduct the amount equivalent to credit disbursed to New Micro Small and Medium Enterprises (MSMEs), who have not availed any credit facilities from banking_system as on 01.01.2021, from their Net Demand and Time Liabilities (NDTL) for calculation of the Cash Reserve Ratio (CRR).

What is MSME?

- MSME stands for Micro, Small, and Medium Enterprises. In accordance with the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the enterprises are classified into two divisions.

- Manufacturing enterprises: Engaged in the manufacturing or production of goods in any industry

- Service enterprises: Engaged in providing or rendering services

Why MSMEs is important for Indian Economy?

- The further Importance of MSME in India has been described below:

- It creates large-scale employment: Enterprises that are inclusive in this sector require low capital to start up new business. Moreover, it creates a vast opportunity for the unemployed people to avail. India produces about1.2 million graduates per year out of which the total number of engineers are around 0.8 million.

- MSME is the boon for the fresh talent in India.

- Economic stability in terms of Growth and leverage Exports: It is the most significant driver in India contributing to the tune of 8% to GDP. It is helpful in creating a linkage between MSME and big companies even after the implementation of the GST 40% MSME sector also applied GST Registration that plays an important role to increase the government revenue by 11%.

- Encourages Inclusive Growth: The inclusive growth is at the top of the agenda of Ministry for Medium, and small and Medium-sized enterprises for several years.

- Cheap Labour and minimum overhead: In MSME, the requirement of labour is less and it does not need a highly skilled labourer. Therefore, the indirect expenses incurred by the owner is also low.

- Simple Management Structure for Enterprises: MSME can start with limited resources within the control of the owner. For a small enterprise does not need to hire an external specialist for its management. The owner can manage himself. Hence, it could run single-handedly.

Major Challenges Faced by the MSME Sector:

- Lack of Access to Financing Solutions: Most businesses face perennial problems of accessing finance or availing an MSME loan even as the government has implemented measures to make credit for businesses readily available to foster entrepreneurship. The regulatory loopholes that cause a delay in getting licenses, insurance, and certifications also hamper the prospects of MSMEs.

- Technology remains a major deterrent: Most businesses fail to reap the benefits of the latest technological developments in their sector due to a lack of expertise and awareness.

- Labour issues: Most SMEs face frequent labour issues and especially in the new normal times, the ongoing migrant crises has manifested itself as one of the most difficult areas for industries to operate in such times of pandemic.

- Lack of Trust: It is seen that banks refrain from extending MSME loan since the amount remains small and also, banks believe MSMEs lack the required repayment capacity.

Government policies for the growth of MSMEs:

- The Government of India has designed various policies for the growth of

MSMEs in the country.

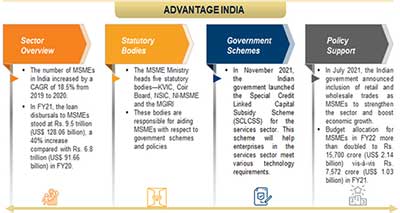

- In November 2021, the Indian government launched the Special Credit Linked Capital Subsidy Scheme (SCLCSS) for the services sector. This scheme will help enterprises in the services sector meet various technology requirements.

- In November 2021, the Ministry of MSME launched SAMBHAV, a national-level awareness programme to push economic growth by promoting entrepreneurship and domestic manufacturing.

- In September 2021, Union Minister for MSMEs introduced ‘India Export Initiative’ and ‘IndiaXports 2021 Portal’. This initiative will help exports reach its US$ 400 billion target by the end of FY22 and further push it to US$ 1 trillion by FY27.

- In September 2021, Khadi and Village Industries Commission (KVIC) launched SPIN (Strengthening the Potential of India).

- The government also announced Rs. 3 lakh crore collateral-free automatic loans for businesses.

- In Union Budget 2021, the government announced funds worth US$ 1.36 billion for ‘Guarantee Emergency Credit Line’ (GECL) facility to eligible MSME borrowers, giving a major boost to the sector.

- The Emergency Credit Line Guarantee Scheme (ECLGS) was announced as part of the Aatma Nirbhar Bharat Package with the objective to help MSMEs and business enterprises to meet their operational liabilities and resume businesses in view of the distress caused by the COVID-19 crisis.

- The psbloansin59minutes Portal was launched in 2018 to facilitate in-principle approval of loans of up to Rs 1 crore (enhanced subsequently to Rs. 5 crore) to MSMEs without human intervention.

- RBI operationalized TReDS in 2017 to solve the problem of delayed payments to MSMEs. TReDS is an electronic platform where receivables of MSMEs drawn against buyers (large corporates, PSUs, Government Departments, etc.) are financed through multiple financiers at competitive rates through an auction mechanism.

- Pradhan Mantri Mudra Yojana (PMMY) scheme was launched in 2015 to provide access to institutional finance to unfunded Micro/Small business units with collateral free loans up to Rs 10 lakh for manufacturing, processing, trading, services and activities allied to agriculture.

Way Forward:

- MSME is the backbone of the Indian economy. This sector has proven the instrumental in the growth of the nation, leverage exports, creating huge employment opportunities for the unskilled, fresh graduates, and the underemployed. It also extended the opportunities to banks for giving more credit to enterprises to MSME Sector. The government should take the special care by addressing the importance of MSME in terms of providing more and more MSME Registration advantages by implementing better regulations and enable financial institutions to lend more credit at less interest rate for sustainability of this sector.

Source: PIB

Mains Question:

Q. “MSMEs sector is referred as new pillars of the Indian economy”. In light of this statement discuss importance of MSMEs for Indian Economy. What are the challenges and government initatives pertaining to the MSMEs sector in India?